One constant you will always have as a salesperson is that you will nearly always have competitors, other companies trying to engage with your customer base and take market share that should belong to you.

There are two rules to immediately remember when it comes to your competition:

Never knock your competition – if you feel that you don’t have a competitive enough offering that you result to belittling and publicly devaluing your competitors in order to make yourself look better as part of your sales strategy (I refer to this as the Tall Poppy Syndrome) then you really need to think again.

Competitors are normally competitors for a reason (ie. they have a product or service that your market is buying, so whilst they have some market share, then they really can’t be that bad!).

Don’t get hung up on your competition – they are there to exercise buyers in your market, raise product and service awareness and act as a benchmark for both the quality and pricing of your products and services.

We need to know what they are up to and how they are approaching the market, but no more. The more we focus on a competitor, the more we end up emulating and copying what they are doing, often subconsciously, and that results in a price-driven marketplace saturated with like products and services.

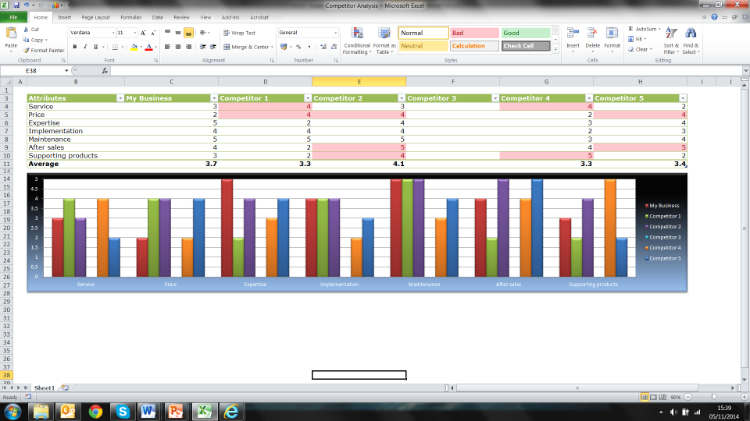

A simple analysis process using a Competitor Map allows you to quickly and simply compare your products and services with those of your key competition so we know how to develop a pitch to put us in a stronger position, considering what they might be offering your target customer base.

Competitor Maps

In order to develop a Competitor Map, we need to start by understanding the key buying criteria of our target customers. In other words, what are the main reasons why customers typically need and therefore buy our products and services in the first place?

These will of course differ from customer to customer, as you would have highlighted through your customer map previously, but every industry, every market, tends to have a series of typical criteria that are deemed more important than others.

If we think back to the conversations we have had with previous customers during the sales cycle, we get a good insight into, historically, what those drivers might have been.

For example, they could include:

Once you have a grasp of these criteria, next identify 5 competitors that you have and who are currently taking some of your market share. The ones you come against the most and who seem to be winning business that you are not.

Your knowledge of your markets and the quality of the relationships you have with your networks within those markets will come in to play here as you start to then assess each of your competitors against those buying criteria you identified previously.

So, for example, let’s take a look at a fictitious company FizzPopDrinks Ltd, a distributor of soft drinks. In their industry it seems that the customers base the majority of the buying decisions on 4 key criteria (they knew this from the data they have maintained from customers they work with now, as well as customers they have lost and the reasons behind both):

Their main competitor, SparklePopDrinks Ltd., have been quite aggressive recently with their marketing and sales activity and have started to take some of FizzPopDrinks’ target customers away from them. In other words, almost 25% of customers that haven’t progressed from In the Funnel to Ready to Close in FizzPopDrinks’ Strategic Sales Funnel have gone on to become customers of SparklePopDrinks.

If we do some research and assess SparklePopDrinks Ltd against those 4 key criteria using a simple traffic light system (green means that this is an area of strength for them, amber means it is just ok, and red means it is an area of weakness for them), we get the following results:

In summary, it would seem that their key strengths and why they are winning more and more business is based around their capability to supply volume products quickly and provide advice and guidance to customers on how to position and therefore sell more products. This is despite their limited support around brand and marketing. The price positioning of their products is fairly average (ie. neither the cheapest on the market nor the most expensive).

If FizzPopDrinks now run a similar process for their business, they score themselves as follows:

This immediately tells them a couple of potential things and gives them some areas for improvement and focus in order to elevate themselves against their competitors:

Try this simple exercise for your business to see where you are excelling or falling short against your competition... and then act!

Published by James Osborne June 8th 2015

Comments